Your credit score is a vital part of your financial health, influencing everything from loan approvals to interest rates. But what exactly is a credit score, and how can you make sure yours stays strong? Let’s break it down.

What is a Credit Score?

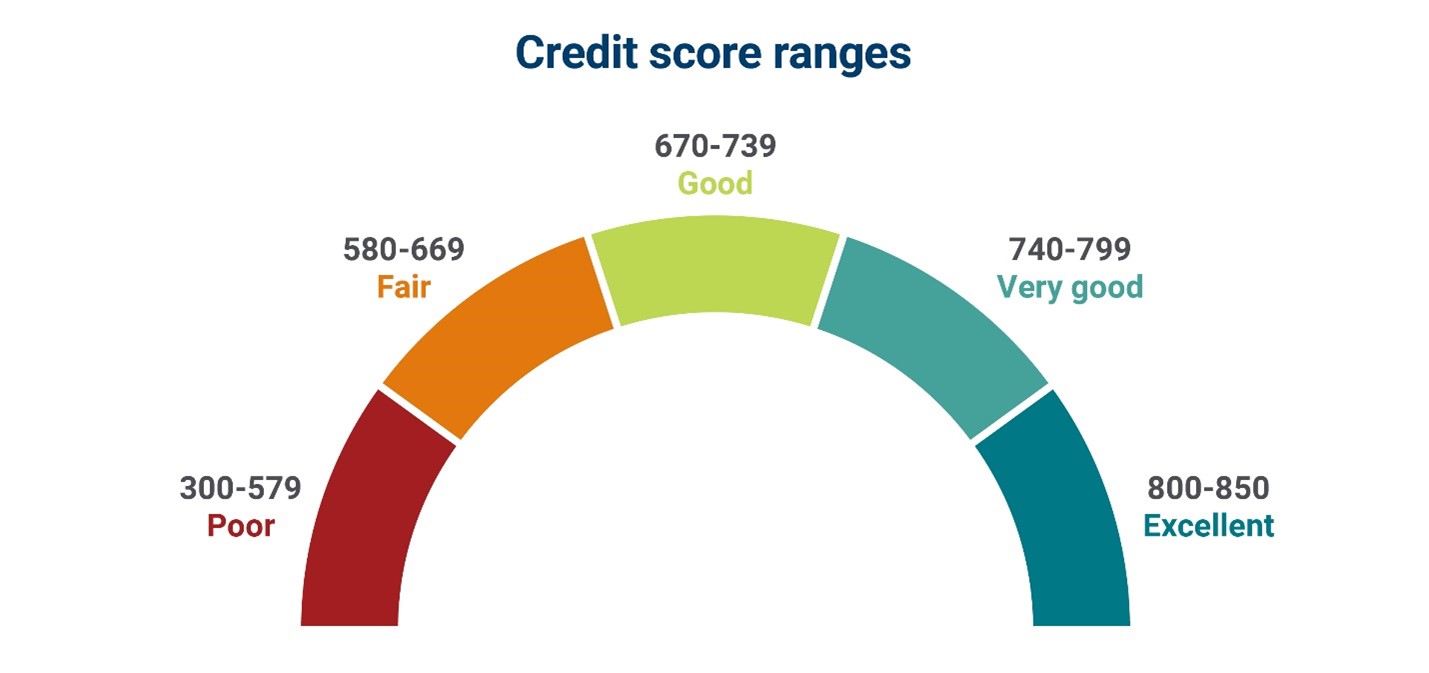

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It’s calculated based on your credit history, including factors like payment history, credit utilization, and length of credit history.

Why Does Your Credit Score Matter?

Your credit score affects:

- Loan approvals and terms

- Interest rates

- Rental applications

- Insurance premiums

How to Improve Your Credit Score

- Pay Bills on Time: Payment history is a significant factor in your score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit.

- Avoid Opening Too Many Accounts: Multiple inquiries can lower your score.

- Check Your Credit Report Regularly: Monitor for errors and dispute inaccuracies.

By taking these steps, you can boost your financial health and open doors to better opportunities.

Take Control of Your Financial Future! For more in-depth strategies on managing your finances, check out Making Money Make Cents by Bernie Ruffin. Purchase your copy today!

Leave a Reply