Category: Money

-

How to Retire Early (FIRE Movement): Build Wealth and Clock Out Before 40 and The 50+ Game Plan: 5 Years to Freedom

Forget the gold watch at 65. That’s old-school. The FIRE (Financial Independence, Retire Early) movement is flipping retirement on its head—and millennials and Gen Z are the new retirement rebels. Instead of slogging it out in a cubicle until Social Security kicks in, people are ditching the 9–5 by 30, 35, or 40. Sound too

-

Using Technology to Earn Extra Income: 7 Smart Ways to Boost Your Bank Account

Let’s be real, costs are up, and sometimes your 9-to-5 just isn’t cutting it. Thankfully, technology has made it easier than ever to create extra income streams from the comfort of your home (or anywhere with Wi-Fi). Whether you want to pad your savings, fund a passion project, or pay off debt, there’s a tech-powered

-

Where to Invest When the Economy Feels Unsteady: Finding Safe Havens in an Unstable Market

In times of economic uncertainty, like the one we’re living in now, the financial markets can feel more like a casino than a place for long-term growth. Volatility, inflation, rising interest rates, and geopolitical tensions all have investors on edge. With the stock market taking people on a rollercoaster ride and traditional savings accounts offering

-

The Government & Wall Street: A Profitable Partnership

The government and Wall Street operate in a symbiotic relationship. The Federal Reserve sets interest rates, controls inflation, and manages the money supply, while Wall Street reacts by adjusting investments, borrowing strategies, and market prices. Here’s how they influence your financial world: 1. The Federal Reserve: The Market’s Puppet Master The Federal Reserve (the Fed)

-

Surviving Today’s Economy: Tariffs, Inflation, and the Rising Cost of Eggs

The American economy is facing some serious headwinds. From rising tariffs to stubborn inflation and skyrocketing grocery prices, especially on essentials like eggs, the cost of living continues to challenge everyday Americans. Many families are feeling the pinch at the checkout line, at the gas pump, and even in their monthly bills. But what’s really

-

Understanding Bankruptcy: Can It Really Help You Financially?

Bankruptcy is a financial term often surrounded by fear and confusion. Many people wonder: does filing for bankruptcy help, or does it create more problems? Understanding what it means to file for bankruptcy and its potential benefits and drawbacks can help you make informed financial decisions, whether for personal finances or your business. What Does

-

Turning $1,000 into Opportunity: Smart Investments for Beginners with Bad Credit

If you have $1,000 and less-than-stellar credit, the goal should be to maximize your financial position while improving your credit score. Here’s a detailed plan, broken into actionable steps: Step 1: Improve Your Financial Foundation Before investing, ensure you’re on solid ground financially. Step 2: Invest the Remainder Wisely With the remaining $200-$300, explore low-risk,

-

Investing for Beginners: Where to Start and What to Know

Investing can feel intimidating, especially if you’re new to managing money. But as Bernadette Ruffin outlines in her insightful book Making Money Make Cents, getting a handle on your finances and learning how to invest doesn’t have to be complicated. This guide is here to help you break down the basics of investing while incorporating

-

Top 10 Reasons Making Money Make Cents Should Be Your Go-To Financial Guide

Are you ready to take control of your financial future? If you’re searching for a powerful, practical, and empowering guide to mastering your finances, look no further than Making Money Make Cents by Bernie Ruffin, MBA. Here are the top 10 reasons why this book should be your go-to financial guide: 1. Perfect for Beginners

-

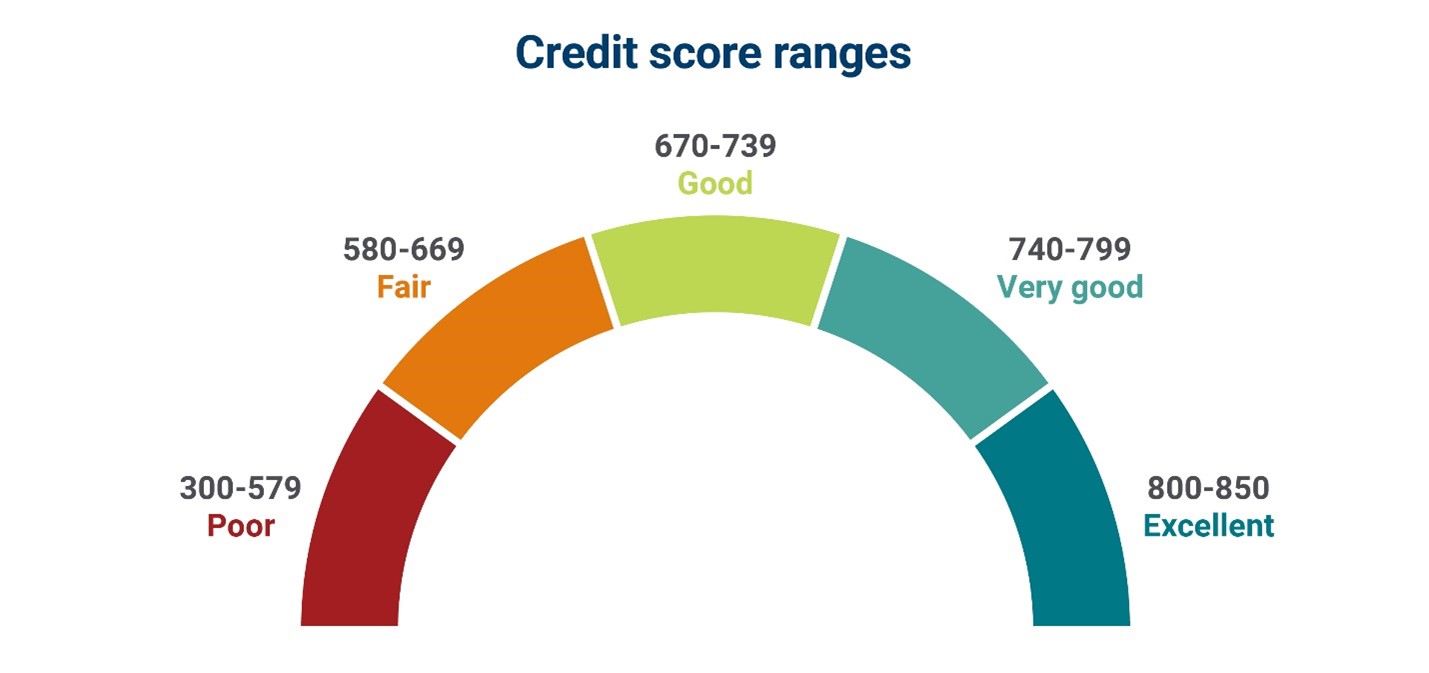

Understanding Credit Scores: What They Are and How to Improve Yours

Your credit score is a vital part of your financial health, influencing everything from loan approvals to interest rates. But what exactly is a credit score, and how can you make sure yours stays strong? Let’s break it down. What is a Credit Score? A credit score is a numerical representation of your creditworthiness, typically

Recent Posts

- How to Retire Early (FIRE Movement): Build Wealth and Clock Out Before 40 and The 50+ Game Plan: 5 Years to Freedom

- The Great Currency Shift: De-Dollarization, BRICS, and the Rise of Central Bank Digital Currencies

- Using Technology to Earn Extra Income: 7 Smart Ways to Boost Your Bank Account

- Where to Invest When the Economy Feels Unsteady: Finding Safe Havens in an Unstable Market

- How to Build Your Emergency Fund… Even If You Have Little

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…